A gift tax is a federal tax owed by a person who gives something valuable to another without expecting to get anything of equal or greater worth in return.

Even if the individual donating didn’t intend for it to be a gift, the tax could nevertheless be applied to anything of great value that is given as a gift, such as large quantities of money or real estate.

How much you can give before filing a return and paying taxes is governed by the Internal Revenue Service (IRS).

Any amounts that exceed the yearly criteria must be reported and counted against the lifetime gift tax exemption. When this substantial exemption is out, the gift tax is due.

Cash Gifts Up To $16,000 Per Year Are Exempt From Reporting

Depending on the quantity of the gift, cash donations may be subject to tax rates ranging from 18% to 40%.

Although the gift-giver is responsible for paying the tax, most persons will never have to do so because of yearly and lifetime exceptions.

If you have credit card check payday loans guaranteed approval, then you can give overly expensive gifts without any doubts. Gifts of $16,000 might be made in 2022 without incurring any taxes or filing obligations.

The yearly exclusion threshold will rise to $17,000 in 2023. The cap is set per individual, so a couple, for example, might give a combined gift to each of their children in a single year of up to $32,000.

Giving money to family members as gifts can be a key part of an inheritance strategy. Giving family members tax-free gifts of money or other assets while you’re still alive might be a terrific way for you to see how much such presents help your loved ones.

Certain monetary contributions, such as those made to cover tuition or medical expenses, are exempt from tax obligations.

However, you must deliver the presents directly to the hospital or school to be eligible for this exception. Any gift given to a person, whether directly or indirectly, without receiving full payment in return.

How The Lifetime Gift Tax Exclusion Operates

You also receive a $12.09 million lifetime exclusion in 2022 on top of the $16,000 yearly exclusion. In 2023, this amount will increase to $12.92 million.

Married couples can also remove twice that much in lifetime gifts because it is per person. When you’re distributing more than $16,000, that is helpful. Consider a bucket or a cup. Any surplus “spills over” into the lifetime exclusion container.

The $16,000 yearly exclusion will be exhausted, for instance, if you gift your brother $50,000 this year.

Unfortunately, you’ll have to submit a gift tax return, but it’s wonderful because you probably won’t have to pay any gift taxes.

Why? Simply put, the additional $34,000 ($50,000 – $16,000) counts towards your lifetime exclusion.

If you gift your brother $50,000 more the next year, the same thing will occur: you will exhaust your annual exclusion and lose more of your lifetime exclusion.

This lifetime exclusion is reported on the gift tax return. If you don’t make any gifts while you’re alive, you can utilize the entire lifetime exclusion amount after you pass away to reduce your estate taxes. Understand the estate tax system better.

Simple calendar monitoring is another method that might help you prevent an unpleasant surprise.

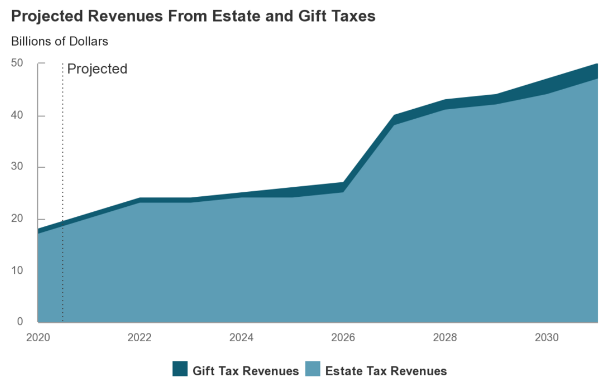

The lifetime exclusion amount will go back to being around $5 million (inflation-adjusted) per person in 2026, where it was before 2018. In 2020, federal estate and gift taxes brought in a total of $17.6 billion, which will only rise.

Strategies To Financially Support My Loved Ones Without Gift Taxes?

You don’t have to let gift taxes stand in the way of sharing your money with your loved ones and friends. Through careful preparation, you may strive to guarantee that you can transfer the greatest amount of your money tax-free.

Use The Yearly Exclusion

Giving to a person is tax-free up to the yearly exclusion threshold, which is currently $15,000. If you’re married, your spouse may also gift the same person the yearly exclusion amount. This is an easy method to increase your contribution by double.

Medical And Educational Costs Should Be Paid Directly To The Institution

If you give money to a loved one to aid with medical or educational fees, don’t do it to them directly. Pay the expenses directly to the healthcare provider or educational organization instead.

You can donate more since the IRS does not classify these expenses as gifts for gift tax purposes.

Gift Tax Planning

The gift tax can be avoided or minimized with the right tactics. These consist of the following:

Splitting Gifts

You may double your presents by two after you are married. Keep in mind that the yearly exclusion pertains to the maximum amount of gifts that one can provide a receipt for.

As a result, spouses can make separate gifts of $16,000 or $17,000 to the same recipient in 2022 or 2023 even if they file a combined tax return. This essentially raises the present’s value to $32,000 or $34,000 per year without incurring the gift tax.

Rich couples can provide significant annual presents to children, grandkids, and others using the gift-splitting approach.

This gift may be given in addition to another one, such as tuition paid directly to a grandchild’s school or college, which is completely free from the gift tax.

Gift In Trust

Donors can make contributions that exceed the yearly exclusion without incurring tax liability by setting up a particular kind of trust—the Crummey trust is the typical arrangement—to collect and distribute the monies.

Money distributed through trusts often is subject to something other than gift tax exclusion. However, a Crummey trust gives the recipient a fixed amount of time—say, 90 days or six months—to take the assets.

The recipient has what the IRS calls a present interest in the trust, and such a type of distribution may be considered a non-taxable gift.

Of course, the receiver is only permitted to withdraw an amount up to the donation amount made to the trust.

Conclusion

In most cases, the gift tax must be paid by the giver. Under unique circumstances, the donee could consent to pay the tax instead. If you are thinking about a situation like this, please speak with a tax expert.