Inflation appeared to be a bit lower in December compared to higher summer rates. Consumer prices that have been increasing at a quick pace for several decades finally slowed down.

They are closing out this year in which the rates of inflation hit new records in four decades.

High inflation rates greatly challenged the Federal Reserve’s ability to keep the U.S. economy on track.

Keep on reading to learn more about consumer price changes and ways to hedge against inflation.

Current Economic Situation

The major factor that defines inflation rates is the consumer price index. Inflation closed out in 2022 with an annual reading of 6.5%, as measured by the CPI, according to the U.S. Bureau of Labor Statistics.

Over the 12 months ended June 2022, the CPI increased 9.1 percent – its largest increase in 40 years – while it decreased 0.3 percent prior to seasonal adjustment for the month of December 2022.

There is a moderation of the inflation rates today, which is encouraging for consumers whose budget is tight.

Due to rising inflation rates, more Americans have to rely on various loans in California online, such as personal, installment, payday loans, which is a common way of receiving additional cash in the short term.

Inflation And The CPI

In December 2022, the CPI decreased by 0.1 percent on a seasonally adjusted basis after increasing 0.1 percent in November.

This was the first decline since May 2020 and beat forecasts of a flat reading. Slowing down the American economy will help to fight inflation.

Speaking of stocks and bonds, US stock indexes rose, and bond yields decreased after the release of a new consumer price index.

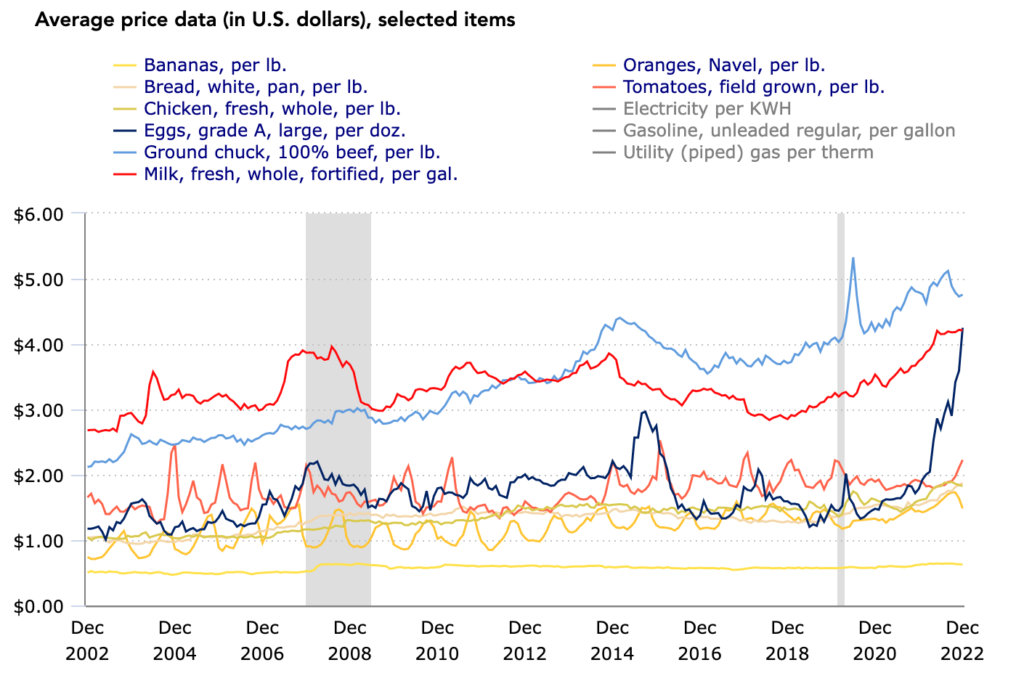

According to the US Bureau of Labor Statistics, the average price data for certain product types grew significantly in 2022.

For instance, the median price for bread was $1.87 per lb. in December 2022 compared to $1.27 four years ago.

The average milk price was $4.21 in December 2022 compared to $2.88 in 2018. The average egg price was $4.25 per dozen in December 2022 compared to $1.60 in 2018.

What Do Economists Pay Attention to?

Even though inflation rates slowed down a bit, the prices for services and goods didn’t fall but just stopped increasing so rapidly.

Consumers understand that policymakers can’t control volatile categories as their prices change fast, and they more frequently borrow money app that helps improve their financial situations.

There are many examples. The war in Ukraine is a rather flashy example, as oil markets were roiled due to Russia’s invasion while gas prices went up.

Even margarine prices surged as Ukraine used to be the largest sunflower oil producer. It’s essential to look closely at inflation to understand what will happen with the economy in the near future.

If inflation rates are rather stable and low, the monthly core inflation will be 0.2%. In 2022, the US Core Consumer Price Index was 0.30%, compared to 0.20% in 2021 and 0.56% in 2020. This is higher than the long-term average of 0.30%.

Top Survival Methods When Food Inflation Is High

Many Americans may feel stressed due to high food inflation. One of the possible solutions is to boost your earning potential, but it’s not that easy. Here are some survival tactics to hedge against inflation.

Reassess Your Financial Habits

This is a great solution as it helps to understand how you manage your personal finances. If you create a budget and stick to it, you will realize that you are probably overspending.

Changing your spending habits is essential when the prices of goods and services are on the rise.

Be more conservative with your spending categories and make sure you have enough for necessities such as housing, utilities, food, and transport.

Buying In Bulk

Buying in bulk can be a great way to save money, especially when dealing with food inflation. Bulk buying allows you to take advantage of discounts, meaning you can often get more for your money.

It helps reduce time spent shopping and allows you to stock up on ingredients for multiple meals at one time. It’s a great way to ensure you never run out of essentials during busy times.

Buying in bulk also ensures that you are always prepared for unexpected occasions or last-minute gatherings.

If stored properly, it will mean food items have a longer shelf-life and won’t need replacing as frequently, saving you money over the long term.

Consider Growing Your Own Fruits And Vegetables

This can be a great way to reduce your grocery bill. Gardening is not only a great way to save money, but it’s also a hobby that can provide many rewards.

Growing your own food can give you access to fresh, healthy produce whenever you need it, and you’ll know exactly what ingredients were used in the process.

It’s also a great opportunity to experiment with different plants and recipes so that you can get the most out of the experience.

Plus, gardening provides plenty of exercises and fresh air, which are both beneficial for your health.

So if you have the space available and are up for taking on a new challenge, consider growing your own fruits and veggies – it could make a big difference in keeping food inflation down!

Pay Attention To Sales

Speaking of inflation, now is the time to become more serious and frugal. Of course, you shouldn’t hunt for every coupon, but paying attention to sales may save you a lot of cash in the long run. You may visit different stores and compare prices if you shop at sales.

Many stores offer various discounts to help Americans respond to rising inflation rates and hedge against them.

Besides, having a shopping list with you when you head out to the store will be extremely useful for those who suffer from impulse purchases.

The Bottom Line

The rates of inflation hit a new record in four decades. This year was rather intense in terms of inflation, especially during the summer season.

Finally, inflation rates lowered a bit in December. Yet it doesn’t mean the prices for goods and services will go down.

They will mostly remain flat. Reassessing your spending habits, paying attention to sales, buying in bulk, and growing your own fruits and vegetables can help Americans survive during uncertain times and hedge against inflation.